Hello, Hamilton Real Estate Investor!

The interest rates going up 0.5% may have doused our red-hot housing market as real estate prices are gradually falling. We are seeing prices down 5-10% and could go down even more.

Just last week, our client scored a detached bungalow for under $875,000 in Brantford. Also, we recently got a firm offer accepted on a bungalow in Kitchener for $800,000.

Two months ago, we may have needed to pay 5 or 10% more for the same property while also competing against a ridiculous number of offers.

I predicted this, so we advised our clients to sell early in the year ahead of the interest rate increases. Some of them did and cashed out.

Like one of my clients who resigned from their job and is retiring thanks to buying quality cash flowing real estate in a top investment town, holding for some time in the market and, of course, working hand-in-hand with the iWIN real estate team. I shared this post on my Instagram some days back.

And it’s not just us at iWIN real estate experiencing this…

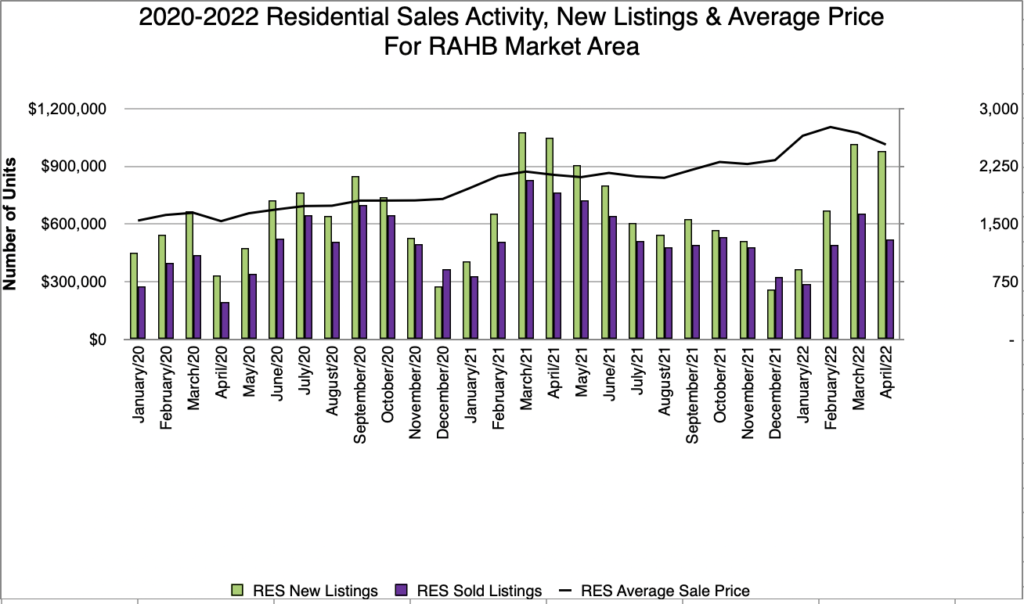

The REALTORS® Association of Hamilton-Burlington (RAHB) reported seeing signs of a balanced Market returning to the Hamilton/Burlington area in their latest press release.

Here are some key points I took away from this press release and some stats we at iWIN real estate are all watching out for:

- The average sale price for residential properties across the RAHB market area was down 5.6% over the previous month.

- New listings in April were down 3.6% month over month.

- Buyers are finally experiencing more choices in the market.

- According to RAHB President Lou Piriano, we experienced another dip for the second month in a row.

What Do Dwindling Real Estate Prices Mean For Canadian Real Estate Investors?

I’m trying to paint a picture of where the market is right now.

As a result of the dip, we can compete against fewer properties. If you are a savvy investor, and I believe you are, you’ll see the opportunity here – there are lots of deals to be made.

It is also important to note that while some people are panicking about interest rates and falling real estate prices, our clients are cruising to retirement and using the opportunity to create some serious cash flow.

My opinion?

It’s a good time to buy, especially since I predict rates will go up soon. Maybe a bit more in the short term, then they have to fall to stimulate the economy and finance cheap debt for all the government spending in the pipeline.

Keep in mind that holding cash-flowing assets like real estate is the perfect hedge against inflation.

If you want to learn how to invest for early retirement like our clients and take advantage of the market for maximized cash flow, we share the secrets at our monthly events.

Fill out the form below to join my email newsletter, and you’ll receive the links to register in your inbox.

Until next time, Just do it! I believe in you.

Happy Hamilton Investing Everyone!

Erwin.